What Does Pvm Accounting Mean?

What Does Pvm Accounting Mean?

Blog Article

5 Easy Facts About Pvm Accounting Explained

Table of ContentsThe smart Trick of Pvm Accounting That Nobody is DiscussingOur Pvm Accounting Statements3 Simple Techniques For Pvm AccountingExcitement About Pvm AccountingThe 9-Second Trick For Pvm AccountingThe Facts About Pvm Accounting RevealedThe Facts About Pvm Accounting Uncovered

In regards to a firm's overall approach, the CFO is accountable for leading the business to meet financial objectives. Several of these approaches might include the firm being acquired or procurements going onward. $133,448 per year or $64.16 per hour. $20m+ in yearly income Professionals have developing needs for workplace supervisors, controllers, accountants and CFOs.

As a company expands, bookkeepers can maximize more personnel for various other organization obligations. This can eventually result in enhanced oversight, higher precision, and much better conformity. With even more sources complying with the trail of cash, a professional is a lot more likely to make money precisely and in a timely manner. As a building and construction firm expands, it will certainly require the aid of a full-time financial staff that's managed by a controller or a CFO to handle the company's funds.

Some Known Facts About Pvm Accounting.

While large services might have full time economic support teams, small-to-mid-sized organizations can hire part-time accountants, accountants, or financial advisors as needed. Was this article practical?

As the building sector remains to flourish, organizations in this sector need to keep solid financial administration. Efficient accountancy techniques can make a significant difference in the success and growth of building and construction companies. Let's check out 5 crucial bookkeeping methods customized especially for the construction industry. By implementing these practices, building organizations can improve their economic security, streamline procedures, and make informed decisions - financial reports.

Comprehensive quotes and budgets are the backbone of construction task monitoring. They aid steer the task towards timely and rewarding completion while protecting the interests of all stakeholders entailed. The vital inputs for job expense estimation and spending plan are labor, products, equipment, and overhead expenses. This is generally among the most significant expenses in building and construction jobs.

All About Pvm Accounting

An exact estimation of materials required for a project will assist make certain the required materials are acquired in a timely manner and in the ideal amount. A misstep right here can bring about wastage or delays as a result of product shortage. For many building and construction projects, equipment is required, whether it is acquired or rented out.

Do not fail to remember to account for overhead costs when approximating task prices. Straight overhead expenditures are certain to a task and may include momentary leasings, utilities, fencing, and water supplies.

Another factor that plays right into whether a job achieves click site success is a precise estimate of when the task will certainly be completed and the related timeline. This estimate aids make certain that a job can be completed within the allocated time and sources. Without it, a task may run out of funds prior to completion, triggering prospective job deductions or abandonment.

The 20-Second Trick For Pvm Accounting

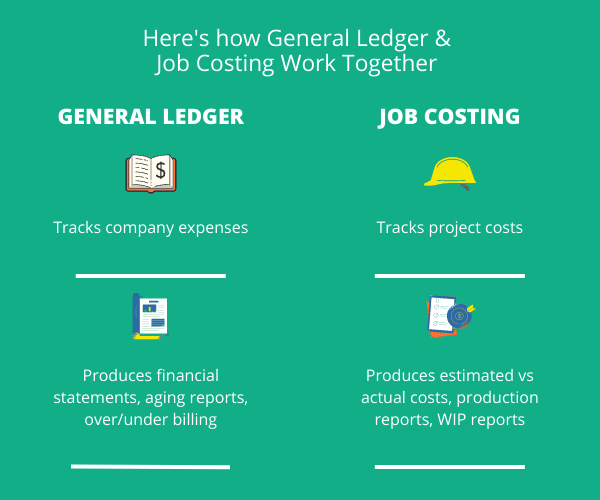

Precise work setting you back can aid you do the following: Recognize the success (or do not have thereof) of each project. As job setting you back breaks down each input into a task, you can track productivity individually.

By recognizing these items while the job is being completed, you prevent surprises at the end of the project and can deal with (and hopefully avoid) them in future projects. A WIP schedule can be completed monthly, quarterly, semi-annually, or each year, and consists of task data such as contract value, costs sustained to date, overall estimated prices, and overall project billings.

An Unbiased View of Pvm Accounting

It likewise offers a clear audit trail, which is important for financial audits. construction accounting and conformity checks. Budgeting and Projecting Tools Advanced software uses budgeting and projecting capacities, enabling building firms to plan future tasks a lot more precisely and manage their funds proactively. Record Administration Construction tasks include a great deal of documents.

Enhanced Vendor and Subcontractor Monitoring The software can track and handle settlements to vendors and subcontractors, making certain timely settlements and preserving excellent connections. Tax Obligation Preparation and Declaring Accounting software application can aid in tax prep work and filing, guaranteeing that all pertinent financial activities are properly reported and taxes are filed promptly.

Pvm Accounting Things To Know Before You Get This

Our client is a growing advancement and construction company with headquarters in Denver, Colorado. With numerous active building and construction tasks in Colorado, we are searching for an Accounting Assistant to join our group. We are seeking a full time Accountancy Assistant who will certainly be accountable for giving practical assistance to the Controller.

Receive and assess day-to-day invoices, subcontracts, adjustment orders, order, inspect demands, and/or other associated documents for completeness and conformity with economic policies, procedures, budget plan, and legal requirements. Precise handling of accounts payable. Get in invoices, authorized attracts, acquisition orders, etc. Update regular monthly evaluation and prepares budget trend reports for building and construction jobs.

Everything about Pvm Accounting

In this overview, we'll look into various facets of construction accountancy, its value, the standard tools utilized around, and its duty in construction projects - https://padlet.com/leonelcenteno/my-epic-padlet-5wtea3s4b3n04ml4. From economic control and cost estimating to capital monitoring, discover how bookkeeping can benefit building tasks of all ranges. Building and construction accounting refers to the specific system and processes utilized to track economic information and make critical choices for construction companies

Report this page